How to Prepare Land for Sale Without Over-Improving It

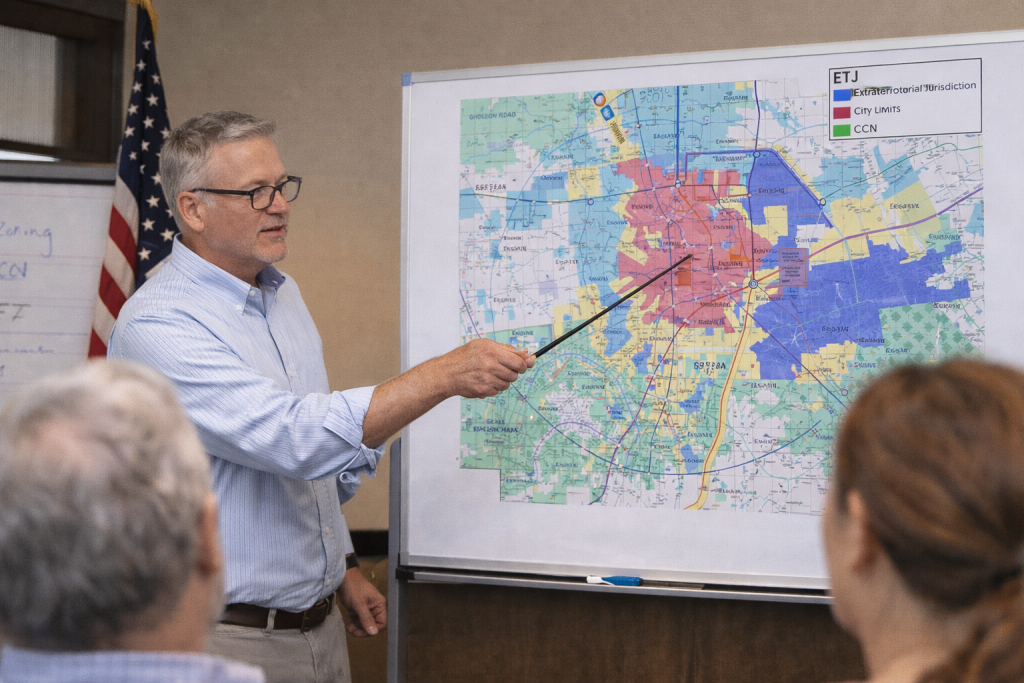

This is where a lot of landowners get tripped up. They want to “do the right thing” before selling, so they start spending money. Clearing. Fencing. Adding features. Sometimes even starting improvements they think buyers will like. And then… the offers come in lower than expected. Preparing land for sale isn’t about doing more. It’s about doing the right things — and stopping before you cross into wasted effort. Let’s walk through how to get land ready for market without over-improving it. First: Understand Who You’re Selling To Before touching the property, ask one question: Who is the likely buyer? A developer, investor, neighbor, or long-term holder all value different things. Improvements that help one buyer can be meaningless — or even annoying — to another. This is where early guidance from a land-focused brokerage like Airstream Realty can prevent expensive missteps before they happen. What Actually Helps Land Value Some prep work really does move the needle. Clear Information (Not Just Clear Land) Buyers pay for certainty. Helpful steps include: Boundary surveys Clear access documentation Utility availability confirmation Zoning and ETJ clarity None of these are flashy, but they reduce buyer friction. That often leads to stronger offers and smoother deals. Strategic Clearing (Not Over-Clearing) Selective clearing can help buyers see the land: Clearing fence lines Opening up access points Removing obvious junk or debris But fully clearing large tracts? Often unnecessary. Many developers prefer to handle that themselves based on their plans. Clearing just enough — not everything — is usually the sweet spot. Fixing Simple Access Issues If access is confusing or blocked, address it. Clear gates, easements, or drive paths can improve first impressions. Buyers don’t want to guess how they’ll get equipment or traffic onto a site. Simple fixes here tend to pay off. What Usually Wastes Money This is where good intentions go sideways. Heavy Improvements Without a Plan Things like: Internal roads Pad sites Small utility extensions Decorative fencing These are often done without knowing the end use. If the buyer doesn’t need them — or plans to remove them — you won’t get paid back for the effort. Sometimes it even hurts value. That one stings. “Pretty” Improvements Developers Ignore Land doesn’t sell like a house. Land buyers don’t care much about: Landscaping Aesthetic fencing Small cosmetic touches Those features don’t increase yield or reduce risk. So they don’t show up in pricing models. Nice idea. Wrong buyer. Over-Engineering Too Early Engineering, plats, or studies done without buyer alignment can miss the mark. Partial entitlements can help — but only when they match realistic demand. Otherwise, you’ve spent money solving the wrong problem. This happens more often than people admit. The Balance: Clean, Clear, Flexible The goal is to present land that’s: Easy to understand Easy to access Easy to imagine developing Not land that’s half-built into someone else’s vision. Keeping flexibility intact often preserves more value than locking buyers into assumptions. This is where experienced brokers add quiet value behind the scenes. At Airstream Realty, a lot of our work happens before a listing ever goes live — helping sellers decide what not to do. How Brokers Add Value Before the Sale A good land broker doesn’t just market property. They help shape it. That includes: Identifying the right buyer pool Advising on minimal, high-impact prep Preventing unnecessary spending Positioning the land correctly from day one Sometimes the best advice is simply: don’t touch it yet. That restraint can be worth more than any physical improvement. FAQs: Preparing Land for Sale Should I clear all the land before selling? Usually no. Strategic clearing helps, full clearing often doesn’t add value unless required for access or visibility. Do buyers expect utilities to be installed? Not always. Buyers care more about access and feasibility than completed infrastructure. Are surveys worth the cost? Often, yes. Clear boundaries reduce buyer hesitation and speed up diligence. Can improvements ever hurt value? Yes. Improvements that limit flexibility or increase removal costs can reduce buyer interest. Should I entitle the land before selling? Sometimes — but only with a clear strategy. Partial steps can help, but full entitlements aren’t always necessary. How do I know what prep work makes sense? Talk to a broker who works with land buyers daily, like the team at Airstream Realty. Guessing usually costs more than asking. Preparing land for sale isn’t about proving effort. It’s about removing friction, preserving flexibility, and letting the right buyer see the opportunity clearly. Do that — and you avoid the most expensive mistake of all: spending money that never comes back.